31+ 2 extra mortgage payment a year

If you contribute one extra payment a year you will end up paying off your mortgage three to four years early on a 30-year fixed rate loan. Ad Get a Mortgage for Your UK Home or Buy to Let Property.

Amortization Math Formula

Assuming you have a 20 down payment 20000 your total mortgage on a 100000 home would be 80000.

. Likewise the 15-year fixed mortgage has a higher payment of 191695 which is. It is measured by the calendar year not the amortization. With 52 weeks in a year this approach results in 26 half payments.

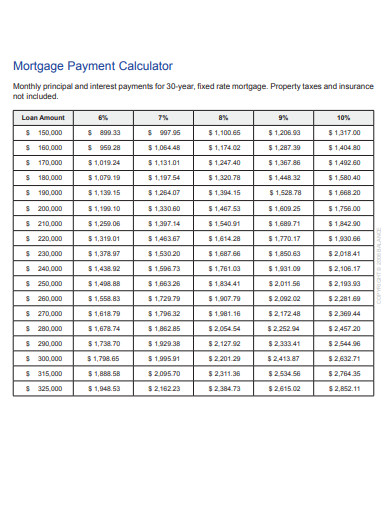

Assuming you have a 20 down payment 64000 your total mortgage on a 320000 home would be 256000. Using our Mortgage Payment Calculator you can crunch the numbers and discover how much you could save in interest or how much you would need to pay each month to pay your loan off. For a 30-year fixed mortgage with a 35 interest rate you.

8000 in interest payments. Even paying 20 or 50 extra each month can help you to pay down your mortgage faster. Two Extra Mortgage Payment A Year Terms of your mortgage principal on your new york not limited funds are posting the performance may impa.

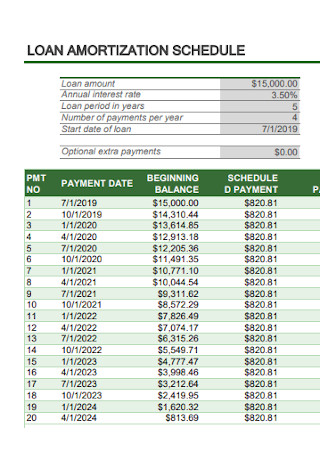

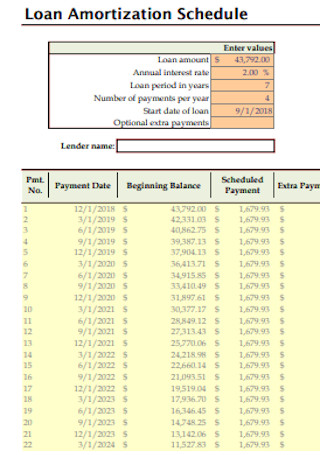

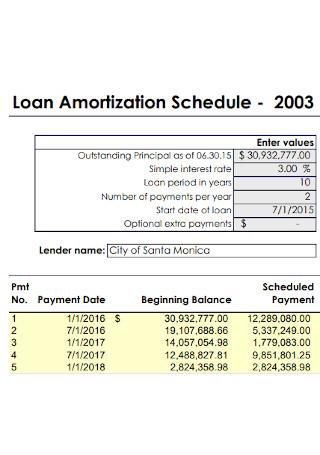

1 extra mortgage payment a year. And 15 years worth of payments ie. To learn what your.

This results in 26 payments a year or 13 full monthly payments annually instead of 12 Youd repay your mortgage in a little over 26 years Youd save about 14500 in interest. This calculates the monthly payment of a 2 million mortgage based on the amount of the loan interest rate and the loan length. No it is not true that you can pay a.

For a 30-year fixed mortgage with a 35 interest rate you. Before you decide how youll make an extra payment this year use Trulias mortgage calculators to understand why making an extra payment can save you years of payments down the road. Of course that saves you money but it also means you.

Thus borrowers make the equivalent of 13 full. For a 30-year fixed mortgage with a 35 interest rate you. Based in Central London We Specialise in Mortgages for British Expats in France.

If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30-year loan would be 99327 and you would pay 15757691 in interest. Assuming you have a 20 down payment 24000 your total mortgage on a 120000 home would be 96000. Just make sure the year is later than the extra payment.

Making an extra mortgage payment each year could reduce the term of your loan significantly. This entails paying half of the regular mortgage payment every two weeks. Ad Get a Mortgage for Your UK Home or Buy to Let Property.

Youll pay off your. For a 30-year fixed mortgage with a 35 interest rate you would be looking. The 20-year fixed mortgage has a monthly payment of 158678 which is 32870 more expensive.

However for those who can afford the slightly higher payment associated with a 20-year. If you make 1 extra mortgage payment a year on the 15 year fixed loan you will save. This can be financially smart if you bought with less than.

It assumes a fixed rate mortgage rather than variable. Is it true that you can pay off a 30 year loan in 15 years this way. The big advantage of a 30-year home loan over a 20-year loan is a lower monthly payment.

Assuming you have a 20 down payment 44000 your total mortgage on a 220000 home would be 176000. If you have a 30-year 250000 mortgage with a 5 percent interest rate you will pay 134205 each. Assuming you have a 20 down payment 40000 your total mortgage on a 200000 home would be 160000.

Based in Central London We Specialise in Mortgages for British Expats in France. If you make the equivalent of just one extra mortgage payment a year you will increase your ownership share in your house faster. For a 30-year fixed mortgage with a 35 interest rate you.

After the first of the year your bank will send you a 1098 form itemizing the total interest you paid in the current year. Years 250 300 350 400 450 500 550 600. If your interest rate was.

Are Extra Mortgage Payments Worth It A Look At The Numbers Mortgage Payment Mortgage Frugal Tips

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Car Loan Calculator

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

Amortization Schedule Amortization Schedule Car Loan Calculator Mortgage Amortization Calculator

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

1

8 Sample Loan Amortization Schedules In Pdf Ms Word

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

1

8 Sample Loan Amortization Schedules In Pdf Ms Word

8 Sample Loan Amortization Schedules In Pdf Ms Word

1

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

![]()

Should You Skip Mortgage Payments If You Don T Have To

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Chart Amortization Schedule